Future Value of Income Streams

Regular Accumulation Over Time

Recall from a previous lesson that we can use the formula

$$P(t)=P_0e^{rt}$$

to determine the value of an asset over time \(t\) that starts at amount \(P_0\), and compounds (continuously) at rate \(r\). We also mentioned in that same lesson that this formula serves as a good approximation and an upper bound for less frequent compounding (such as daily compounding).

Dividend Re-Investing

There are investment vehicles out there that will occasionally pay you back a certain percentage of your initial investment on a regular basis. This may take the form of a stock dividend, a bond coupon, a crypto staking reward, or some other form. While your original investment compounds at a certain rate over time, you can take these payouts and reinvest them along with your original investment, compounding your returns even more! Let’s take a look at an example where we want to determine how much money we have if we reinvest these payouts.

Let’s consider what happens in our account quarter-by-quarter by the end of the two years.

First, we start with an initial investment of $1000 that we let sit in the account for 8 quarters (4 q’s per year, for 2 years). The value this has after 2 years is

$$V(t)=1000e^{0.03\cdot (2)}$$

After one quarter, we get our first payout of $20, which we will reinvest for the remaining 7 quarters. Thus the future value of our account after one quarter is:

$$V(t)=1000e^{0.03\cdot (2)}+20e^{0.03\cdot(2-\frac{1}{4})}$$

(Note that we are subtracting \(\frac{1}{4}\) from \(2\) in the exponent to represent the fact that we will be compounding that $20 for 7/4 of 2 years (i.e. 7 more quarters); that is, we removed a quarter from our 2 years because one already passed)

Then, repeating the same logic for quarter 2, adding on our 20$ reward compounded over 6 more quarters to what we have so far for our future value, we get

$$V(t)=1000e^{0.03\cdot (2)}+20e^{0.03\cdot(2-\frac{1}{4})}+20e^{0.03\cdot (2-\frac{2}{4})}$$

Rinse and repeat for each of the remaining quarters to get a future value of the account of

$$\begin{align}V(t)&=1000e^{0.03\cdot (2)}+20e^{0.03\cdot(2-\frac{1}{4})}+20e^{0.03\cdot (2-\frac{2}{4})}+20e^{0.03\cdot (2-\frac{3}{4})}+…+20e^{0.03\cdot (2-\frac{7}{4})}+20e^{0.03\cdot (2-\frac{8}{4})}\\&=1226.12\end{align}$$

Continuous Payouts? Yes, that can happen… almost.

There are investments out there that pay out “rewards” or dividends on a more frequent basis. In the cryptocurrency/digital asset world, weekly, daily, or even more rapid payouts are commonplace.

Let’s suppose we found an account/investment that compounds continuously at an annual rate of 4% and we invest $2000 in the account. Suppose also that this account pays out a daily reward of $0.05 that you immediately reinvest upon receipt. How much do we have after two years of this process?

The setup is the same as the example above. However, instead of multiplying each term by $0.05/day for the compounding of each payout, we will write instead \(\frac{18.25}{365}\) (which equals (0.05)), where the \(18.25\) is the represents the total payout for one year. The reason we’re doing this will be (hopefully) clear later.

$$Value(t)=2000e^{0.04\cdot (2)}+\frac{18.25}{365}e^{0.04\cdot(2-\frac{1}{365})}+\frac{18.25}{365}e^{0.04\cdot(2-\frac{2}{365})}+…+\frac{18.25}{365}e^{0.04\cdot (2-\frac{730}{365})}$$

This is a lot of adding that would take a good bit of time to plug into a calculator or even write/code into a spreadsheet. What might be beneficial is, instead of adding up 731 different amounts, we just assumed that the account paid out its rewards continuously (i.e. infinitely often). So this gives us the following limit, where we are driving the number of payouts that are infinitely close together to infinity.

$$\lim_{n\rightarrow\infty} 2000e^{0.04\cdot (2)}+\frac{18.25}{n}e^{0.04\cdot(2-\frac{1}{n})}+\frac{18.25}{n}e^{0.04\cdot(2-2\frac{1}{n})}+\frac{18.25}{n}e^{0.04\cdot(2-3\frac{1}{n})}…+\frac{18.25}{n}e^{0.04\cdot (2-\frac{2n}{n})}$$

Cleaning things up a little bit by breaking up the yearly total payout \(18.25\) and the number of times \(n\) we divide that up per year, and letting \(\Delta t =\frac{1}{n}\) (representing how often we get a payout each year) gives us

$$\begin{align}\lim_{n\rightarrow\infty} 2000e^{0.04\cdot (2)}+18.25e^{0.04\cdot(2-1\cdot \Delta t)}\cdot \Delta t+…+18.25e^{0.04\cdot (2-2n\cdot \Delta t)}\cdot \Delta t \end{align}$$

When we take limits of sums of stuff that is getting infinitely close together, we end up with an integral! This makes sense because are continuously accumulating these rewards, and integrals “sum up” continuous accumulation.

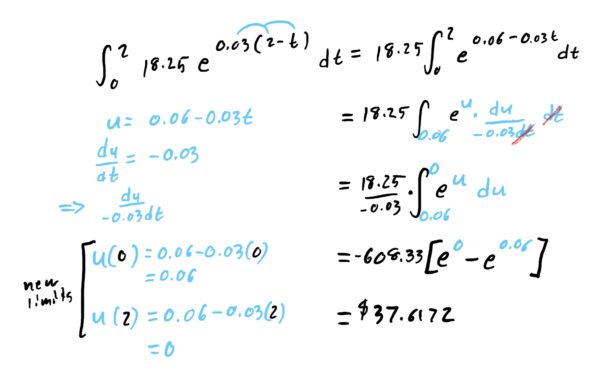

$$\begin{align}\lim_{n\rightarrow\infty} 2000e^{0.04\cdot (2)}+18.25e^{0.04\cdot(2-1\cdot \Delta t)}\cdot \Delta t+…+18.25e^{0.04\cdot (2-2n\cdot \Delta t)}\cdot \Delta t&=\int^2_0 18.25 e^{0.04\cdot(2-t)}\ dt \end{align}$$

Since you cannot receive rewards more than continuously, the above integral gives us an upper bound for how much money we will have in our account after two years. Since there is likely to be little difference in what we’d get if we received daily payouts versus continuous payouts, computing the above integral also gives us a good estimate for the value of our account after 2 years. Below is the computation of the integral part.

Thus, the total value of the account after two years is given by

$$Value(2)=2000e^{0.04\cdot (2)}+37.6172=2204.19$$

In general, we can use the following integral formula to determine the value of a continuously compounding investment that has continuous (or “fast enough” payouts). Again, this is useful for finding upper bounds for accounts with less frequent compoundings.

First thing we need to do here is label all of our quantities so we can make use of the formula given to us above.

Initial amount: \(P_0=5000\)

interest rate: \(r=0.03\)

Account duration: \(T=5\)

Annual Payout amount (the only one that needs to be calculated on occasion): \(A(t)=1.25\cdot 365=456.25\)

Therefore, we can use the formula given above to calculate the total value of the account after 5 years:

$$\begin{align}Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt&=5000e^{0.03\cdot 5}+\int^5_0 456.25\cdot e^{0.03\cdot(5-t)}\ dt\\&=8270.4\end{align}$$

Start by determining which quantities given in the problem match the variables in the formula.

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

Initial amount: \(P_0\)

interest rate: \(r\)

Account duration: \(T\)

Annual reinvested amount (the only one that needs to be calculated on occasion): \(A(t)\)

First label all quantities in the problem description:

- Initial amount: \(P_0=?\)

- interest rate: \(r=?\)

- Account duration: \(T=?\)

- Annual reinvested amount (the only one that needs to be calculated on occasion): \(A(t)=?\)

Then plug them all into the formula:

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

\(10352.66\)

Start by determining which quantities given in the problem match the variables in the formula.

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

Initial amount: \(P_0\)

interest rate: \(r\)

Account duration: \(T\)

Annual reinvested amount (the only one that needs to be calculated on occasion): \(A(t)\)

First label all quantities in the problem description:

- Initial amount: \(P_0=?\)

- interest rate: \(r=?\)

- Account duration: \(T=?\)

- Annual reinvested amount (the only one that needs to be calculated on occasion): \(A(t)=?\)

Then plug them all into the formula:

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

\(\$794296\)

Start by determining which quantities given in the problem match the variables in the formula.

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

Initial amount: \(P_0\)

interest rate: \(r\)

Account duration: \(T\)

Annual total reinvestment amount (the only one that needs to be calculated on occasion): \(A(t)\)

First label all quantities in the problem description:

- Initial amount: \(P_0=?\)

- interest rate: \(r=?\)

- Account duration: \(T=?\)

- Annual reinvested amount (the only one that needs to be calculated on occasion): \(A(t)=?\)

Then plug them all into the formula:

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

\(\$562,645\)

Start by determining which quantities given in the problem match the variables in the formula. Setting up the integral so that things can actually be integrated will require use of exponent rules (i.e. “adding exponents”)

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

Initial amount: \(P_0\)

interest rate: \(r\)

Account duration: \(T\)

Annual total reinvestment amount (the only one that needs to be calculated on occasion): \(A(t)\)

First label all quantities in the problem description:

- Initial amount: \(P_0=?\)

- interest rate: \(r=?\)

- Account duration: \(T=?\)

- Annual reinvested amount (the only one that needs to be calculated on occasion): \(A(t)=?\)

Then plug them all into the formula:

$$Value=P_0e^{r\cdot T}+\int^T_0 A(t)\cdot e^{r\cdot(T-t)}\ dt$$

\(\$36.1817\)